Your Digital insurance broker!

As insurance brokers registered with the Chamber of Commerce and Industry (IHK), we prioritize ongoing education and are safeguarded by professional indemnity insurance. This underscores our commitment to expertise and security in our field. We also provided the initial disclosure per legal requirements, emphasizing our dedication to transparency and trustworthiness.

Our team participates in regular training sessions to ensure up-to-date knowledge of insurance products, policies, and regulations. This continuous education is key to our commitment to excellence and customer satisfaction.

By choosing to work with us, you entrust your insurance needs to a team that excels in its expertise and values integrity and customer protection.

Our guiding principle is simple:

We value your trust over the number of contracts you have. Our goal is to ensure your satisfaction, not just accumulate policies.

Free and Fair Consulting

As insurance brokers, we offer you our expertise without burdening you with any additional costs.

Why? Because our commission is already included in the insurance product and does not differ, no matter where you sign the contract.

Our mission is to help you find the best possible insurance coverage that meets your needs.

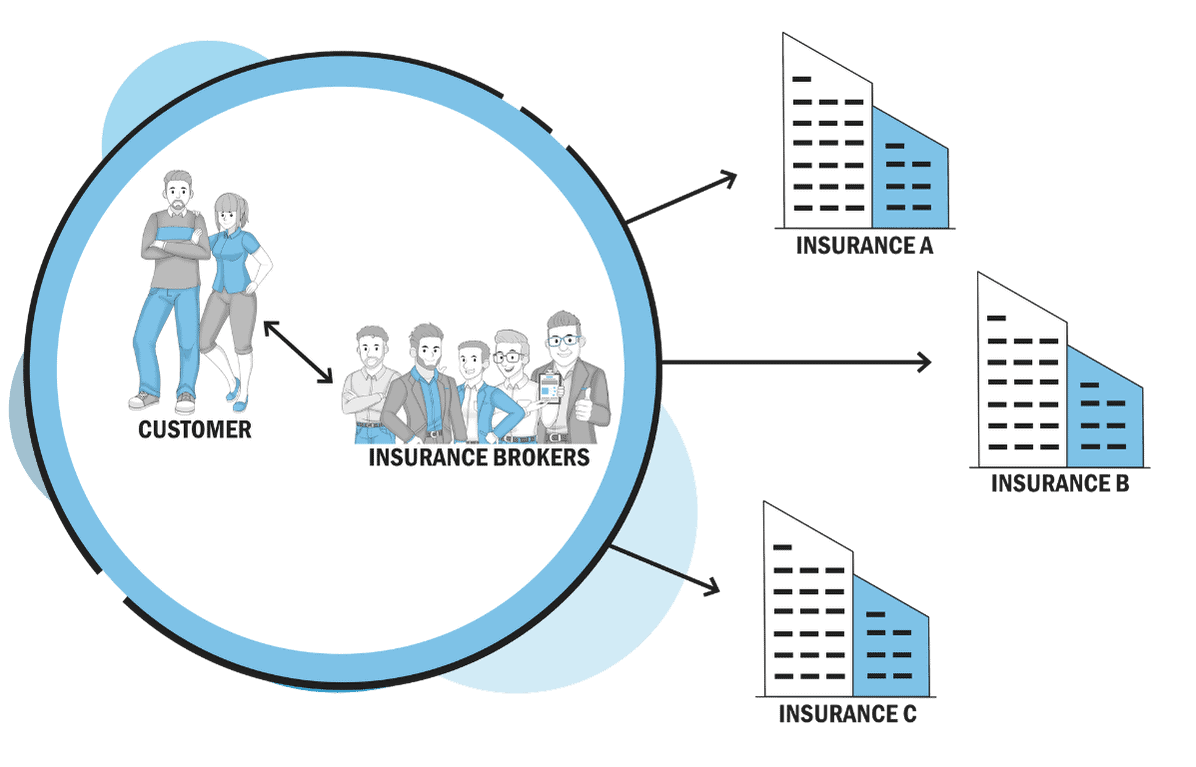

We work independently and compare a sufficient number of offers to ensure that you can make the right decision.

Our advice is based on a solid market and information foundation, allowing us to offer you transparent and tailored solutions.

Your satisfaction is our top priority.

Personalized insurance guidance in

🚀 3 MODULES

Property insurance

MODULE I: Exploring the Depths of Insurance*

In this module, we will cover a wide range of topics including liability, legal, and household insurance.

Google Reviews

Reimagining the Role of an Insurance Agent:

An insurance agent represents one or more specific insurance companies, promoting their products to potential clients.

These agents maintain an exclusive partnership with the insurers they represent, which limits the variety of options they can offer customers.

Benefits of Working with an Insurance Agent:

An insurance agent's focused approach to a narrower selection of products allows for deep familiarity with the services provided by their associated insurance companies.

.webp)

Your Interests First with Our Independent Insurance Brokerage

We represent our clients' interests, putting ourselves in the client's situation to provide recommendations tailored to their specific needs.

As the fiduciary of our clients, we operate independently from any specific insurance company, offering impartial advice and various options from different insurers.

Unlike insurance agents contracted to one company, we guide clients toward the most suitable insurance solutions without bias, ensuring their interests are always prioritized.

Our compensation comes through commissions or, in some cases, a fee for our advice, ensuring clients don't face extra costs for consultation.

A formal brokerage contract outlines the relationship, detailing both parties' rights, responsibilities, and liability, promoting transparency and clarity in our fiduciary role.

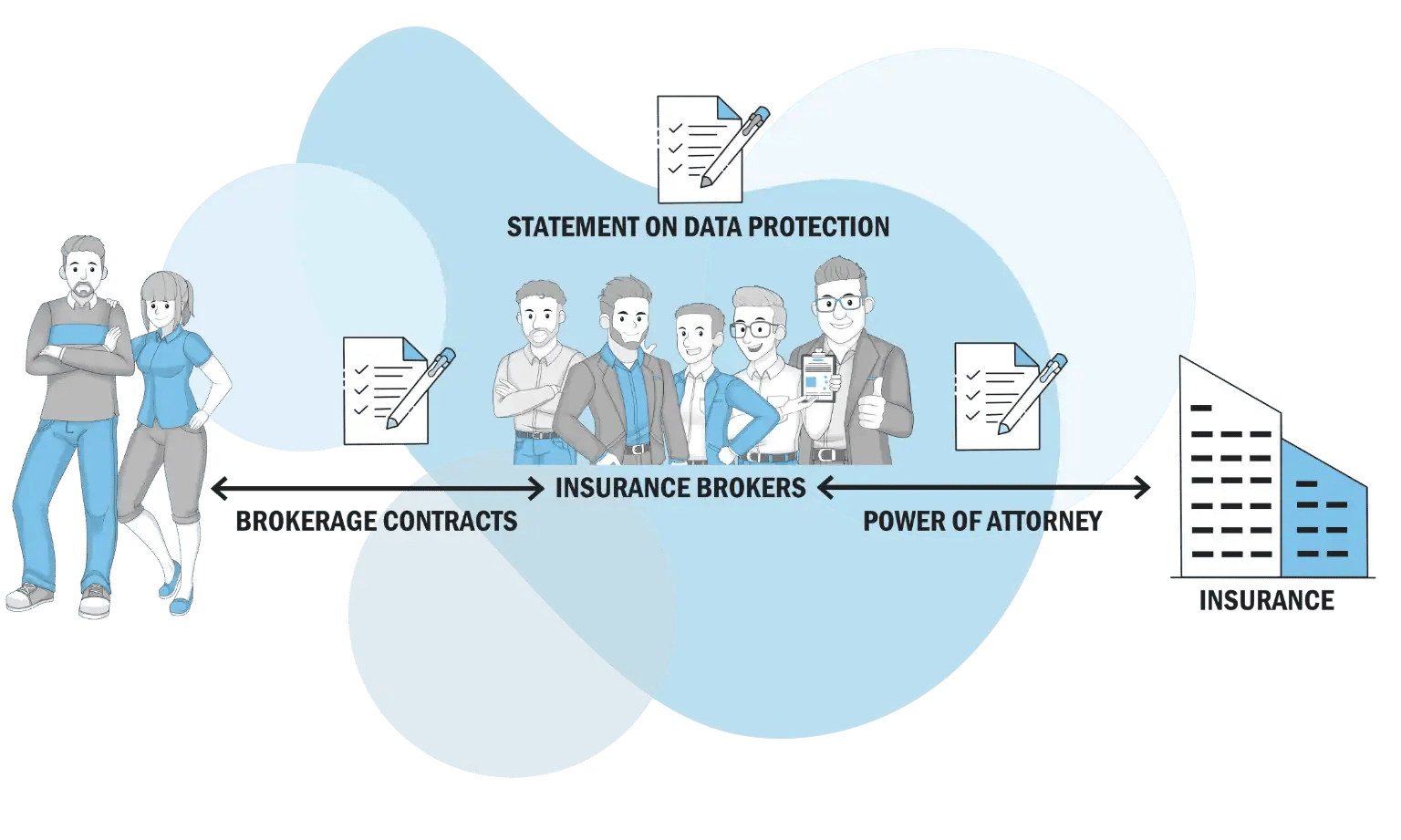

Three documents for a perfect collaboration

Brokerage contract

Consent to data protection

Brokerage power of attorney

Your consent to process your data will help us to take the necessary steps to provide our services. We must emphasize that we will handle your data responsibly and ensure all privacy policies are followed.

You have the right to withdraw your consent or request certain restrictions regarding data processing at any time.

Please don't hesitate to contact us with any questions or concerns regarding data privacy. We will happily give you more information and help you understand your problems.

BLAUDIREKT: Your Personalized and Digital Insurance Companion

Unlock Savings and Optimize Performance with NEODIRECT: Your Path to Clarity and Financial Well-being

- Comprehensive Contract Evaluation

- Independent and Transparent Advice

- Free of Charge Evaluation

- Personalized Assistance, Anywhere

We collaborate closely with Blaudirekt, our IT service provider, who manages our documents and developed the Simplr app to streamline our services.

Competent advice from trained insurance brokers

At Neodirect, our team of insurance experts is here to provide you with reliable and knowledgeable guidance.

With us, only trained insurance experts who are absolute specialists in their fields work to meet your needs.

You can sit back and trust in our competence.

For detailed information about our team members, please visit our team page.

Frequently asked questions - FAQ

What does an anonymous risk assessment mean

We always perform risk assessments for biometric risks anonymously and in advance. This means that we create an anonymous data record and forward only personal data such as date of birth, occupation, and health data to the underwriter of a selected insurance company. The health data will only be assigned to your "personal data" when you submit your application. So, we would also like to prevent your complete data from being sent to other systems.

What does the data processing declaration contain

You can find information on data processing at the following LINK.

Why does Neodirect need a brokerage contract and your brokerage power of attorney?

To hire an insurance broker, a brokerage contract is a prerequisite for cooperation. As the name suggests, both parties to the agreement - you and Neodirect - enter into a contract with each other. Components of this contract are, for example, the rights and obligations of each party. Neodirect, your insurance broker, is responsible for looking for the most suitable insurance coverage. On the other hand, you must inform your NEO (insurance broker) if something has changed in your life since we have no permanent insight into your private life. In the brokerage contract, the rights and obligations of both parties to the agreement are recorded. The broker's power of attorney is a part of this contract to take over the management of your arrangements. It authorizes us to optimize your insurance, for example, to cancel and conclude new contracts for you. Of course, this is only done with your consent and prior agreement, if you don't mind. An essential part of the contract is the possibility of canceling the contract. The contract can be terminated at any time by both parties. You are not bound to Neodirect with a minimum contract period, as you might be used to from other contracts. The cancellation also does not affect your insurance contracts, which remain entirely unaffected.

Why is a declaration of consent for data processing & release from the duty of confidentiality necessary for your brokerage contract/authorization?

The topic of data protection is also written down in the brokerage contract. The DSGVO (Data Protection Regulation) is particularly important in insurance matters. Meanwhile, it applies to many areas on the Internet and at the doctor's. You nowadays receive almost no services without your consent to process your personal data. As an insurance broker, we are also only allowed to work for you with this declaration from you. All the more, it is essential for you to know and trust your insurance broker. Especially in times of Corona, where much work is done from the home office, strict compliance with all data protection-relevant precautions is inevitable.

What is the advantage of the brokerage power of attorney?

You do not need to worry about your insurance by hiring an insurance broker. Your administrative work is almost eliminated. You don't have to check if the benefits of your insurance contracts are in line with the market, you don't have to write a letter of cancellation, you don't have to take care of the optimization of your contracts, you don't have to report any damage to the company. So many advantages for you if your insurance broker takes over this. In Germany, moreover, the full service you get through an insurance broker is free of charge, priced into the premium, and does not cost you a single cent extra. Therefore, the question arises why you should manage your insurance via a comparison portal or transfer the contracts to an utterly foreign broker with the help of an app. We want to work entirely transparently and at eye level with you, not via call center agents and bots. So you always have an actual insurance broker as a contact person who is there for you when you need him. In addition, we offer the possibility to manage your contracts via our Simplr - App and to be always informed day and night, 24 hours a day.

Download the simplr APP!

No contract, and completely free. Activate contracts and get free offers at any time.

-1.webp)

%20(1).webp)